12

LANDFILL TAX

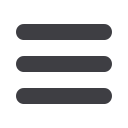

Rates are set to increase by inlation rounded to the nearest 5 pence:

Waste sent to landill

Rate from 1 April

2016

Rate from 1 April

2017

Rate from 1 April

2018

Standard rate

£84.40/tonne

£86.10/tonne

£88.95/tonne

Lower rate

£2.65/tonne

£2.70/tonne

£2.80/tonne

It is reported that since 2000, the amount of waste sent to landill has reduced by 70%

while the average household recycling rates have risen from 18% to 44%.

HAND-ROLLING TOBACCO

The duty rate on hand-rolling tobacco increases with effect from 6pm on 16 March 2016 by

5% above RPI. This represents an additional 3% rise above the tobacco duty escalator.

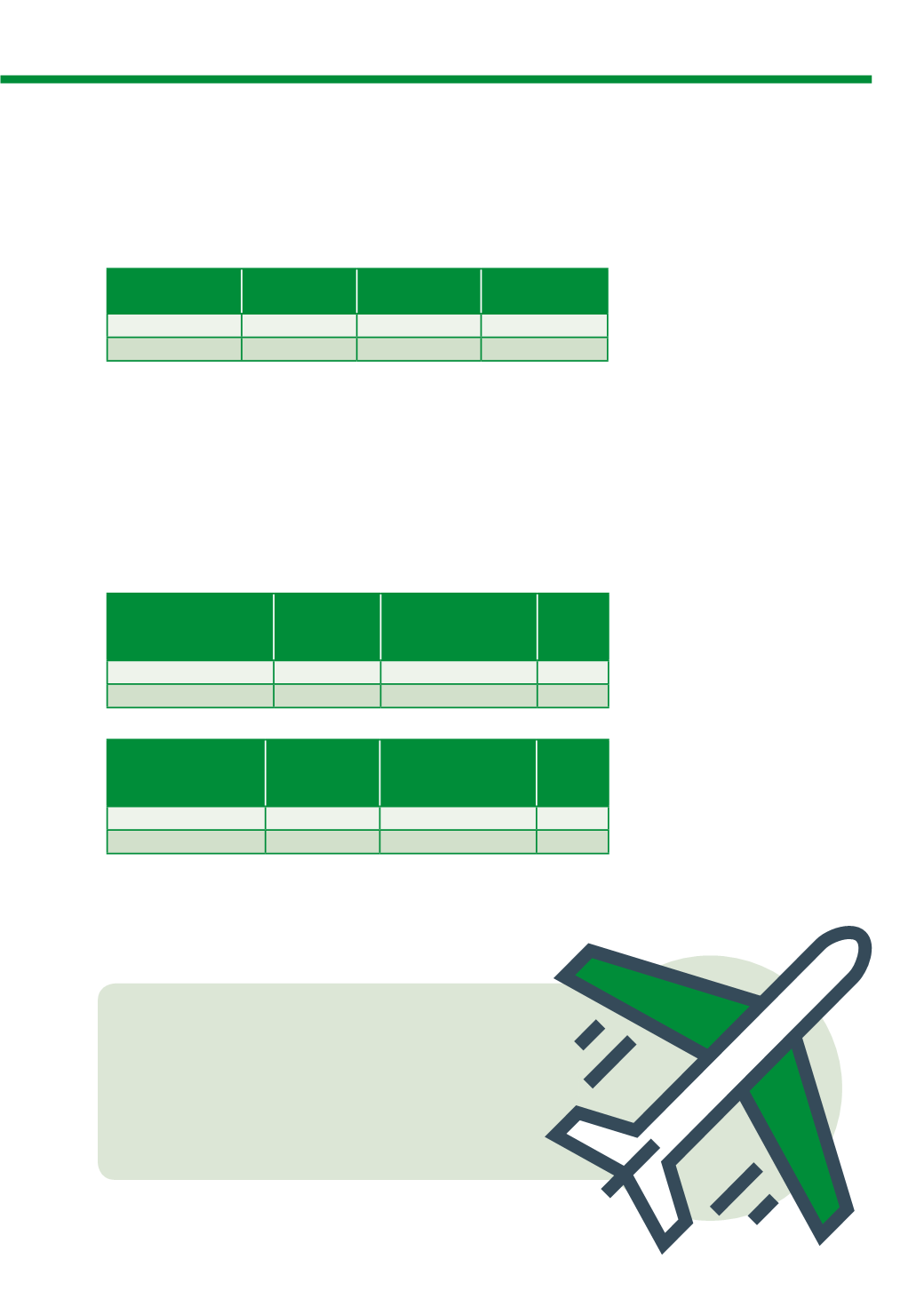

AIR PASSENGER DUTY

Duty rates are set to increase in line with RPI.

From 1 April 2016:

Bands (distance in miles

from London)

Reduced rate

(lowest class of

travel)

Standard rate (other than

lowest class of travel)

Higher

rate

Band A (0 – 2000 miles)

£13

£26

£78

Band B (over 2000 miles)

£73

£146

£438

From 1 April 2017:

Bands (distance in miles

from London)

Reduced rate

(lowest class of

travel)

Standard rate (other than

lowest class of travel)

Higher

rate

Band A (0 – 2000 miles)

£13

£26

£78

Band B (over 2000 miles)

£75

£150

£450

GAMING DUTY

Duty is paid by casinos on their gross

gaming yield. Rates range from 15%

which applies to the irst £2,370,500 of

gross gaming yield (GGY) up to 50%.

The 50% rate applies to any GGY that

exceeds the aggregate of the bandings to

which the 15%, 20%, 30% or 40% apply.

If the bandings were not increased in line

with inlation then more GGY would be

subject to higher rates.

The increase in gaming duty bans will

take effect for gaming duty accounting

periods starting on or after 1 April 2016.

AIR PASSENGER

DUTY TO INCREASE

FROM 2016